How Life Insurance Could Help Mitigate Taxes in Retirement

9/1/2022

Assets in tax-deferred retirement accounts will eventually be taxed as ordinary income — whether distributions are taken by the current owner or a beneficiary who inherits the account — so taxpayers with well-funded retirement accounts should bear in mind that today's historically low income tax rates are scheduled to expire after 2025.

Taking IRA distributions while taxes are low and shifting the money to life insurance could provide a hedge against future tax increases. Here are three ways in which permanent life insurance can be used to fund retirement and estate strategies.

Supplement Retirement Income

The cash value is available for emergencies as well as for normal retirement expenses such as housing costs and health care. You can generally make tax-free withdrawals (up to the amount paid in premiums) or use loans to tap into the accumulated cash value. Although policy loans accrue interest, they are free of income tax (as long as they are repaid) and usually do not impose a set schedule for repayment. Still, you should generally have a need for life insurance protection and evaluate a policy based on its merits as such. Loans from a life insurance policy will reduce the policy's cash value and death benefit, could increase the chance that the policy will lapse, and might result in a tax liability if the policy terminates before the death of the insured. Additional out-of-pocket payments may be needed if actual dividends or investment returns decrease, if you withdraw policy cash values, or if current charges increase.Help Pay for Long-Term Care

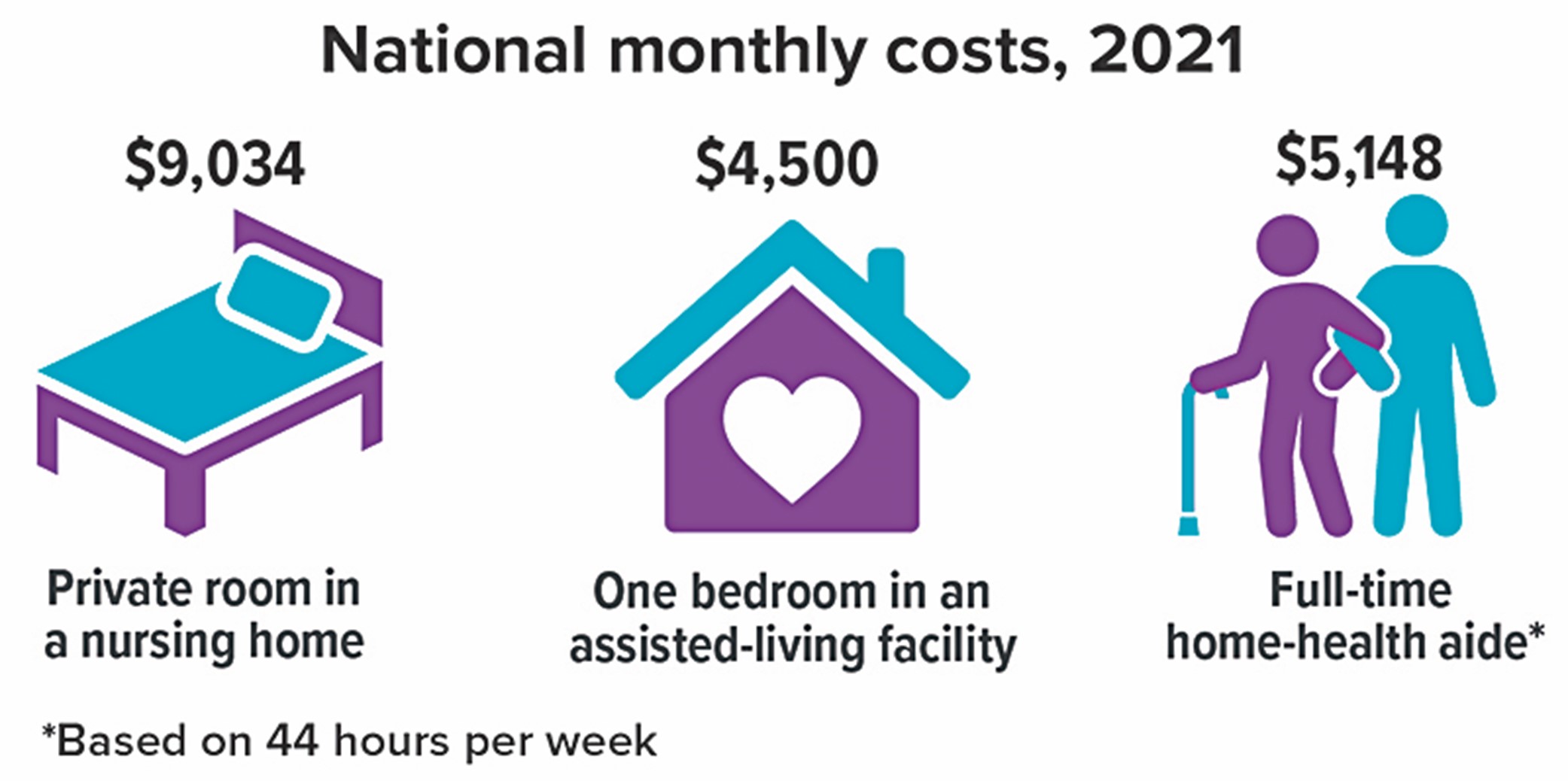

Many retirees worry that their savings could be depleted later in life by the escalating cost of long-term care. A long-term care rider attached to a life insurance policy could help pay for these expenses if they are ever needed. Any payouts for covered expenses would reduce (and are usually limited to) the death benefit, and they are typically much less generous than those of a traditional "use-it-or-lose-it" long-term care policy. Optional benefit riders are available for an additional cost and are subject to the contractual terms, conditions, and limitations outlined in the policy; they may not, however, benefit all individuals.Budgeting for Long-Term Care

Medicare pays for up to 100 days in a skilled nursing facility after a qualifying hospital stay of three or more days, and provides limited coverage for home health care. Medicaid pays for some long-term care services, but eligibility is based on the person's income and assets, and often requires "spending down" to qualify.

Source: Genworth Cost of Care Survey, 2022

Leave a Tax-Free Legacy

Most nonspouse beneficiaries who inherit IRAs must now empty the account within 10 years, and heirs who are forced to take distributions in their peak earning years could face large income tax bills. By contrast, the death benefit from a life insurance policy could provide a tax-free inheritance.Before implementing a strategy involving life insurance, it would be prudent to make sure you are insurable. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. In addition to the life insurance premiums, other costs include mortality and expense charges. If a policy is surrendered prematurely, there may be surrender charges and income tax implications. Any guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company.